What to look for when Halliburton Company (HAL) reports Q4 2024 results?

Halliburton Company (NYSE: HAL) is expected to report fourth-quarter results on Wednesday, January 22, at 6:45 am ET. The oilfield service provider is currently recovering from a rough patch, marked […] The post What to look for when Halliburton Company (HAL) reports Q4 2024 results? first appeared on AlphaStreet.

Halliburton Company (NYSE: HAL) is expected to report fourth-quarter results on Wednesday, January 22, at 6:45 am ET. The oilfield service provider is currently recovering from a rough patch, marked by challenges like weather disruptions and a major cyberattack that compromised its systems.

For the Houston-based company’s stock, 2024 was not a great year, as it experienced a steady downtrend despite starting the year on a positive note. Over the past five months, the stock has traded below its long-term average price of $33.08. It has lost around 18% in the past six months, all along underperforming the market.

As Halliburton prepares to publish its fourth-quarter results on January 22, Wall Street forecasts earnings of $0.69 per share on revenues of $5.63 billion. In the corresponding quarter a year earlier, it earned $0.86 per share and generated $5.63 billion of revenue. Interestingly, in the most recent quarter, the company’s earnings missed analysts’ forecast for the first time in more than a decade.

Growth Plan

The company provides oil field solutions and technologies in more than 70 countries, for the exploration and production of oil and natural gas. Currently, its business strategy is focused on adopting new technology and reducing costs to achieve operational efficiency and enhance profitability. The energy giant is optimistic about innovative projects like the fully automated hydraulic fracturing program it launched in North America in partnership with Coterra Energy, and expansion into new markets like Namibia.

“Halliburton’s largest international business lines, cementing, completion tools, and drilling fluids, form the backbone of oil and gas development spending globally, and each is a leader in their market. We’ve earned these leadership positions through our legacy of execution, consistent service quality, and our digital and technology developments. The transformation of our Sperry Drilling business clearly demonstrates the impact technology developments have on our business,” said CEO Jeffrey Allen Miller in a recent interaction with analysts.

Weak Q3

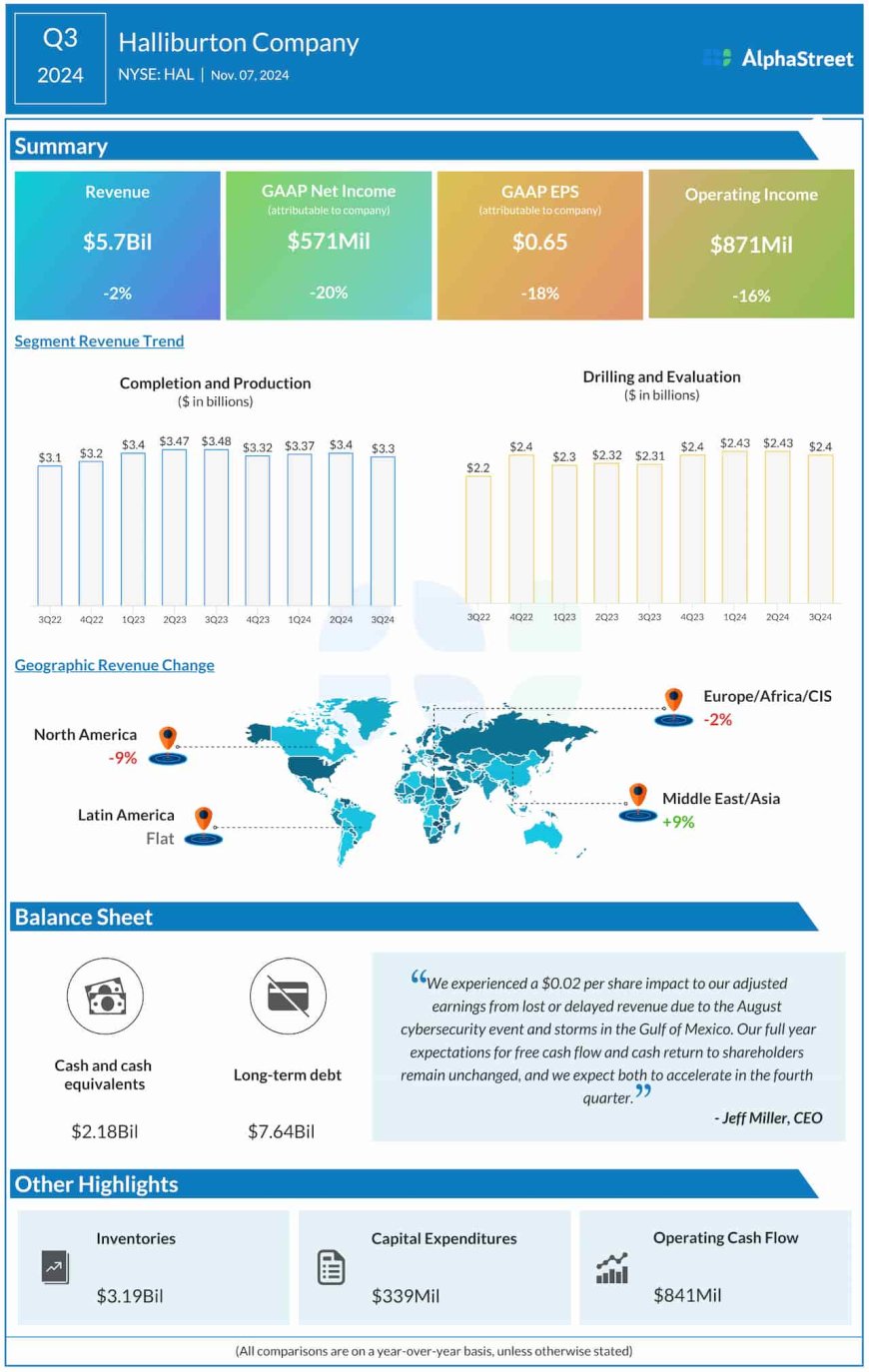

In the three months ended September 2024, the company’s net profit decreased to $571 million or $0.65 per share from $716 million or $0.79 per share in the comparable period a year earlier. At $0.73 per share, adjusted earnings were down 8% year-over-year and below expectations. Third-quarter revenue declined 2% annually to $5.70 billion and came in below estimates, marking the second straight miss. In North America, revenues declined by 9%.

Halliburton’s shares maintained a steady uptrend this week, hovering near the $30 mark. They mostly traded higher during Thursday’s regular session.

The post What to look for when Halliburton Company (HAL) reports Q4 2024 results? first appeared on AlphaStreet.