What to expect when Starbucks (SBUX) reports its Q1 2025 earnings results

Shares of Starbucks Corporation (NASDAQ: SBUX) stayed green on Friday. The stock has gained 6% over the past month. The coffee chain giant is slated to report its earnings results […] The post What to expect when Starbucks (SBUX) reports its Q1 2025 earnings results first appeared on AlphaStreet.

Shares of Starbucks Corporation (NASDAQ: SBUX) stayed green on Friday. The stock has gained 6% over the past month. The coffee chain giant is slated to report its earnings results for the first quarter of 2025 on Tuesday, January 28, after market close. Here’s a look at what to expect from the earnings report:

Revenue

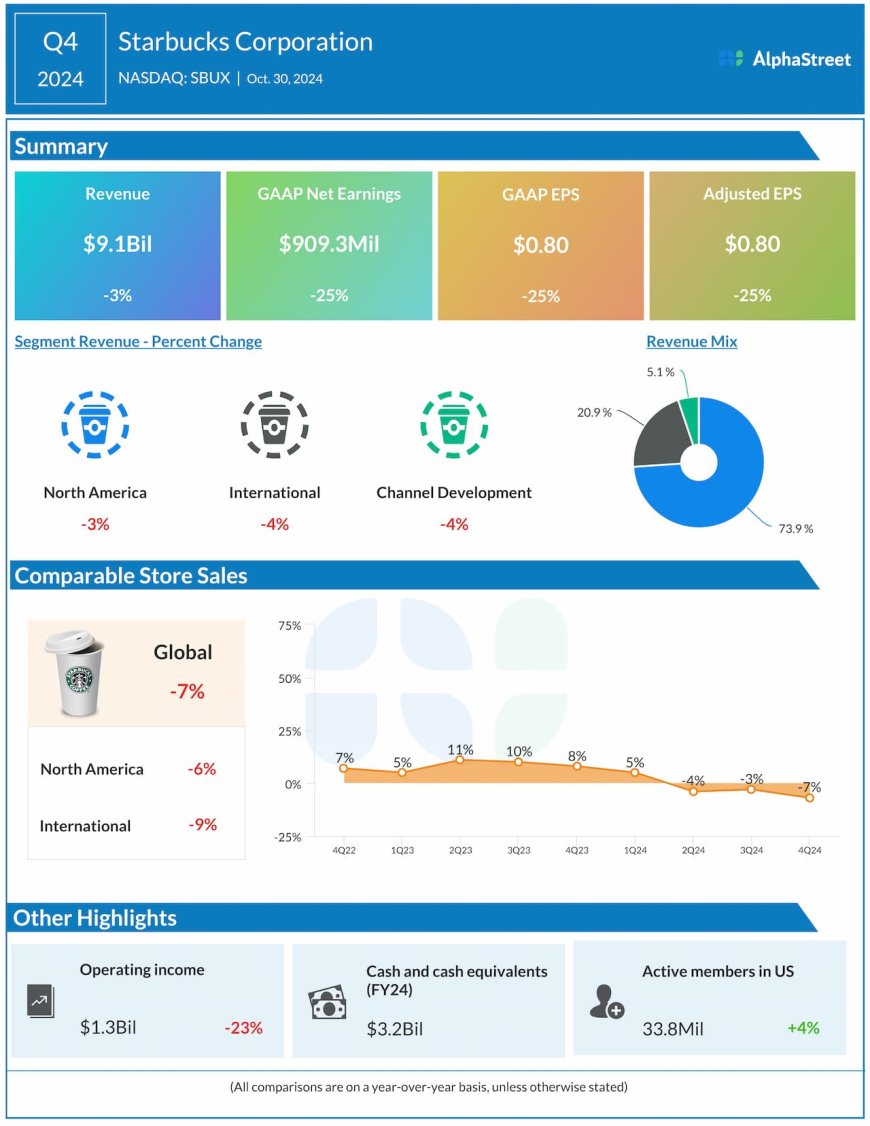

Analysts are projecting revenue of $9.32 billion for Starbucks in Q1 2025, which implies a drop of 1% from the same period a year ago. In the fourth quarter of 2024, revenues declined 3% year-over-year to $9.1 billion.

Earnings

The consensus estimate for earnings per share in Q1 2025 is $0.67, which indicates a decrease of 25% from the adjusted EPS of $0.90 reported in Q1 2024. In Q4 2024, adjusted EPS fell 25% YoY to $0.80.

Points to note

Starbucks’ main challenge has been its traffic decline. The coffee chain has seen a drop in traffic across all its channels and dayparts. Its comparable transactions in the US fell 10% in Q4, which led to a 6% decrease in US comparable store sales. It has also seen traffic fall among its Starbucks Rewards members as well as non-members, as promotions and new offerings failed to generate interest.

In addition, SBUX has been facing continued headwinds in China from heavy competition and a tough macro environment, which led to a decrease in comparable store sales caused by declines in average ticket and transactions. Slow traffic from non-SR members and lower sales of high-ticket items also took a toll on comps.

In Q4, operating margin contracted 370 basis points from the previous year due to higher promotions and investments in wages and benefits. These pressures were partly offset by pricing and in-store operational efficiencies.

Starbucks has been taking several measures to improve its customer experience in-store and through its Mobile Order & Pay service. The company is simplifying its menu and restructuring its pricing. It is reducing the frequency of discount-driven offers. It is bringing back condiment coffee bars in its cafes and rolling out Clover Vertica brewers in all its locations. It is also working on improving its mobile ordering capabilities.

Some of these initiatives may have helped drive traffic and revenue in the first quarter, but increased investments might put pressure on profits.

The post What to expect when Starbucks (SBUX) reports its Q1 2025 earnings results first appeared on AlphaStreet.