United Airlines looks on track for positive Q4 results, despite challenges

After recovering from the prolonged slowdown that followed the pandemic, the airline industry still faces multiple headwinds including supply chain issues and delivery delays. While experts warn that the challenges […] The post United Airlines looks on track for positive Q4 results, despite challenges first appeared on AlphaStreet.

After recovering from the prolonged slowdown that followed the pandemic, the airline industry still faces multiple headwinds including supply chain issues and delivery delays. While experts warn that the challenges might persist in 2025, the upcoming earnings report of United Airlines Holdings, Inc. (NYSE: UAL) is expected to provide insights into the emerging trends in the aviation market.

New High

The current value of United’s stock is nearly double its 52-week average price. In 2024, the value more than doubled, with most of those gains occurring in the latter half of the year. Continuing the uptrend, the stock climbed to a new high in the last trading session. Even after the strong gains, UAL is expected to remain a top-performing stock this year, offering a buying opportunity that long-term investors wouldn’t want to miss.

Wall Street is optimistic about the airline’s financial performance in the final months of fiscal 2024. The Q4 report is slated for release on Tuesday, January 21, at 4:00 pm ET. On average, analysts covering the company expect its profit to increase to $3.0 per share in the December quarter from $2.0 per share in the year-ago quarter, on an adjusted basis. The projection is above the company’s guidance of $2.5-$3.0 per share, with the midpoint at $2.75. Analysts’ estimate for fourth-quarter revenue is $14.33 billion, representing a 5.2% year-over-year increase.

Road Ahead

In recent quarters, the company’s bottom line benefitted from an uptick in passenger traffic and a decline in fuel expenses. The management expects costs to come under pressure from capacity reductions and delivery delays from Boeing and Airbus. Recently, United expedited the deployment of Starlink’s high-bandwidth, low-latency internet to provide high-quality in-flight connectivity, with the first commercial flight expected this quarter. The strategy of enhancing customer experience through personalization and self-service tools is significant considering the stiff competition in the US aviation industry. United has been striving to catch up with Detta Air Lines, the most profitable passenger airline company.

From United Airlines’ Q3 2024 earnings call:

“A de-commoditization of customers are choosing United based on the wide selection of products from premium international seats to flexible travel for domestic business travelers and basic economy for our price-sensitive customers. Our investments have solidified a leading position for us in the industry. As our strategy has worked, our relative profitability has improved materially, but our stock hasn’t kept up. We believe there’s tremendous value in our shares and now have the balance sheet and free cash flow to opportunistically repurchase those shares.”

Mixed Q3

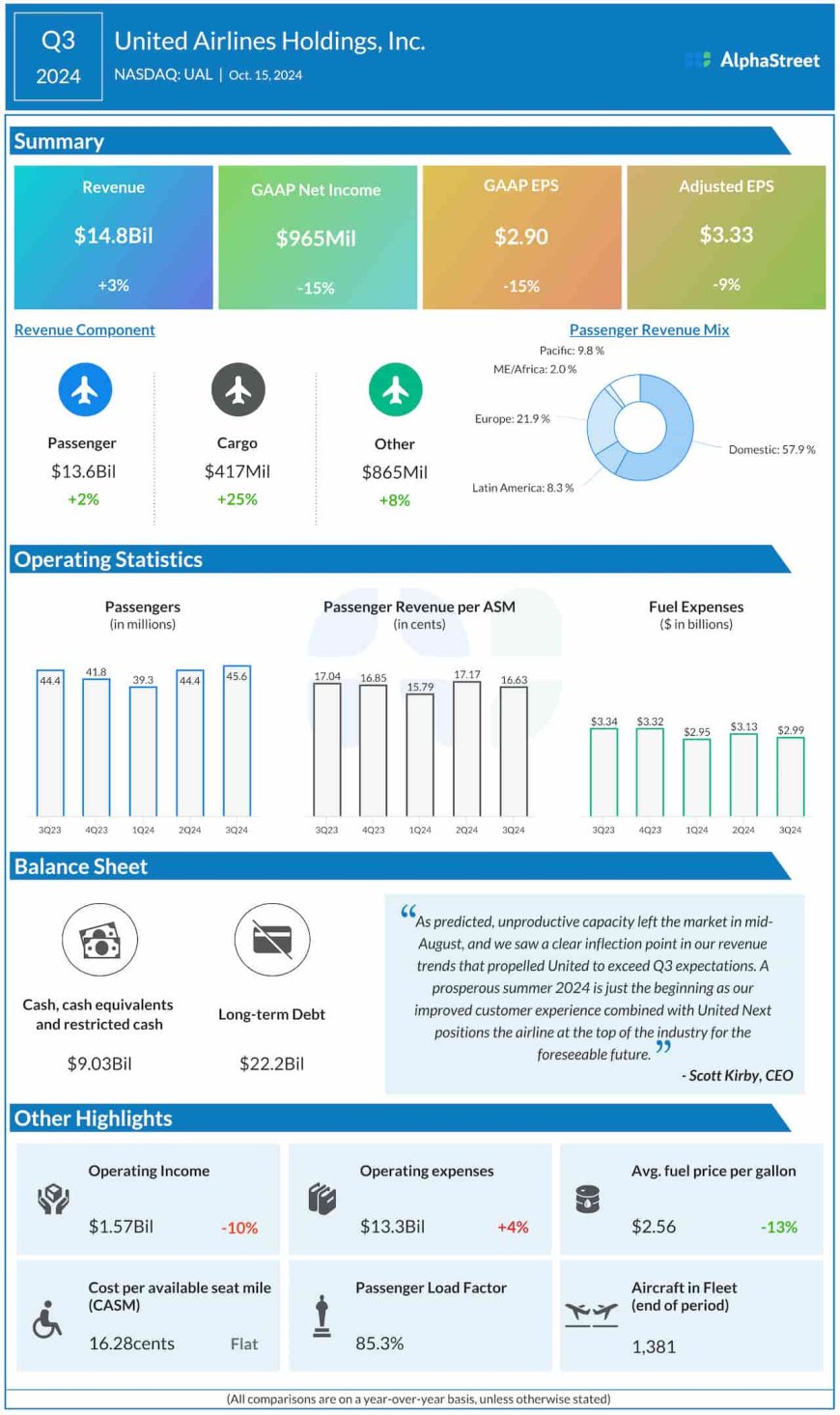

In the third quarter, net income decreased to $3.33 per share from $3.65 per share in the corresponding period a year earlier, excluding special items. United’s quarterly profit has beaten estimates regularly over the past two years. On an unadjusted basis, net profit dropped to $965 million or $2.90 per share in Q3 from $1.14 billion or $3.42 per share in the year-ago quarter. Meanwhile, revenues increased to $14.84 billion in the September quarter from $14.48 billion in Q3 2023 and topped expectations.

The stock experienced weakness in early trading on Monday, reversing some of the recent gains. It has gained around 11% in the past month.

The post United Airlines looks on track for positive Q4 results, despite challenges first appeared on AlphaStreet.