Kroger (KR) bets on stable customer engagement to beat challenges

For The Kroger Co. (NYSE: KR), a leading grocery chain with a strong presence across the US, 2024 has been a year of both hits and misses. While competitive prices […] The post Kroger (KR) bets on stable customer engagement to beat challenges first appeared on AlphaStreet.

For The Kroger Co. (NYSE: KR), a leading grocery chain with a strong presence across the US, 2024 has been a year of both hits and misses. While competitive prices and the management’s digital engagement strategy continued to drive sales, the business came under pressure from the growing competition in the grocery market and legal issues.

The Cincinnati-headquartered retailer’s stock mostly traded sideways this week, after climbing to an all-time high of $61.08 last month. KR has grown about 32% so far in 2024, though the stock pared some of its early gains later on. Soon after the release of the third-quarter earnings report, investor sentiment was dampened by the management’s cautious guidance and deepening uncertainty over the Albertsons deal.

Mixed Q3

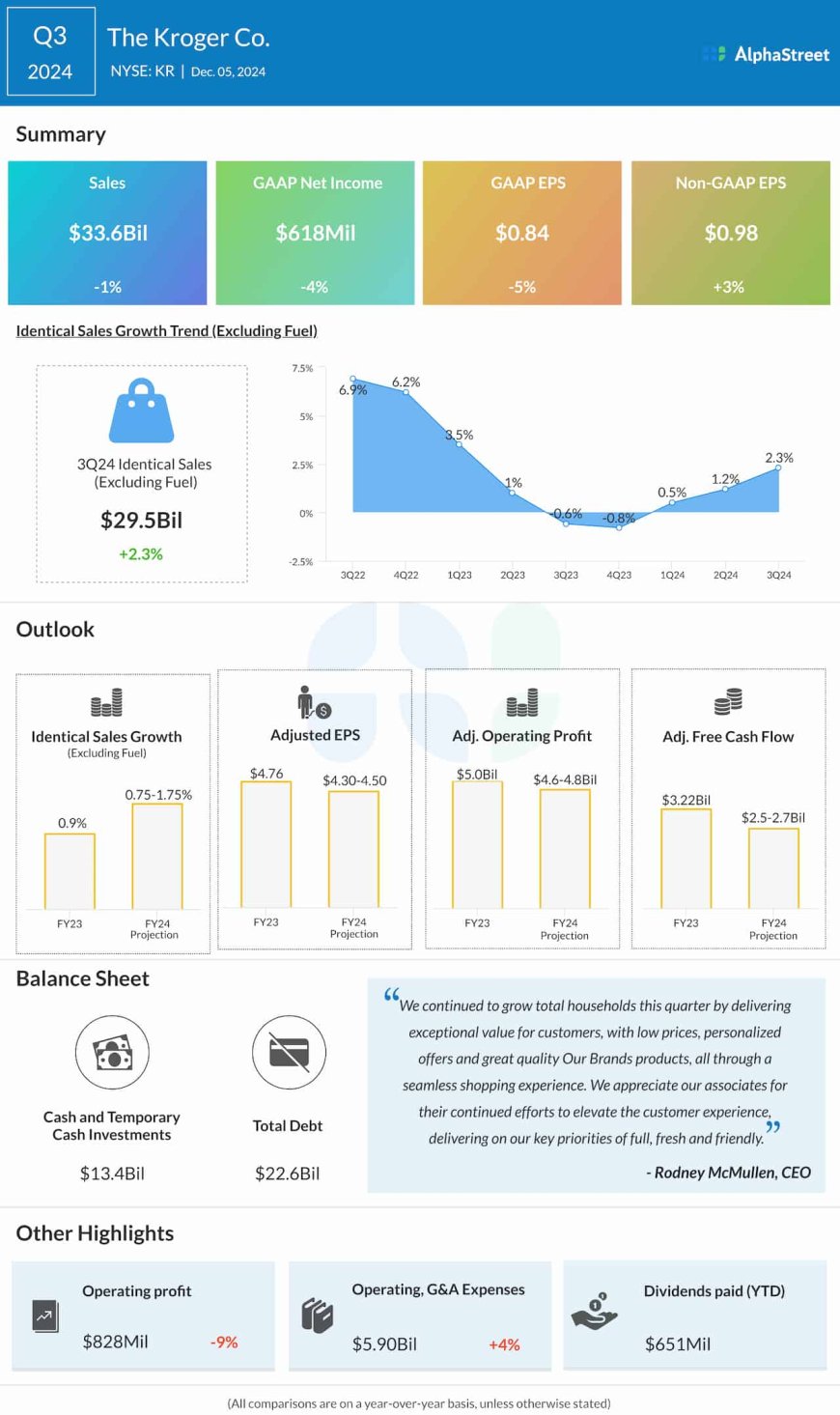

The company reported net sales of $33.6 billion for the October quarter, which is broadly unchanged from the $34/billion sales it generated in the prior-year quarter. The top line was negatively impacted by lower fuel sales and the recent sale of the specialty pharmacy business to Elevance Health.

Identical sales, without fuel, increased by 2.3% year-over-year during the three months. Adjusted net income rose to $0.98 per share in the third quarter from $0.95 a year earlier, matching estimates. On an unadjusted basis, net earnings were $618 million or $0.84 per share in Q3, compared to $646 million or $0.88 per share in Q3 2023.

While Kroger has an impressive track record of regularly reporting stronger-than-expected quarterly earnings, sales often missed estimates in the recent past. However, the company has maintained stable top-line performance despite cautious consumer spending and growing competition from industry leaders Walmart and Amazon.

Innovation

The retailer’s investments have been focused on customer-facing innovations lately, including those focused on expanding its private label offerings and strengthening e-commerce. Meanwhile, Kroger’s electronic shelf label system met with mixed reactions, with some customers and lawmakers raising concerns that it could lead to surge pricing.

From Kroger’s Q3 2024 earnings call:

“Customer engagement remains strong. Our convenient seamless shopping experience, along with incredible customer value through low prices, personalized offers, and great quality Our Brands products, drove growth in both total and loyal households. As we entered the last quarter of 2024, we are focused on providing quality, fresh, and affordable products that make holiday celebrations special. Customer spending habits continue adjusting to current macroeconomic factors.”

Uncertainty

Kroger’s pending merger with Albertsons, delayed due to regulatory issues, suffered a fresh setback after the Federal Trade Commission recently put the deal on hold citing antitrust concerns, in a landmark decision. Having challenged the FTC’s decision in court, the Kroger leadership has taken an optimistic view of the future of the business, irrespective of whether the merger occurs or not.

Kroger’s stock dropped slightly in the early hours of Friday and traded around $60, which is above its 52-week average price of $52.90.

The post Kroger (KR) bets on stable customer engagement to beat challenges first appeared on AlphaStreet.