FedEx (FDX) is preparing to report Q2 results. Here’s what to expect

FedEx Corporation (NYSE: FDX) has merged its operating segments into a single entity as part of an extensive reorganization aimed at cutting costs and achieving operational efficiency. The market is […] The post FedEx (FDX) is preparing to report Q2 results. Here’s what to expect first appeared on AlphaStreet.

FedEx Corporation (NYSE: FDX) has merged its operating segments into a single entity as part of an extensive reorganization aimed at cutting costs and achieving operational efficiency. The market is closely monitoring the company’s upcoming earnings as it consolidates the business amid multiple headwinds, such as inflation, supply chain disruption, and stiff competition.

FedEx’s shares experienced high volatility after withdrawing from a record high in mid-June. The stock, which has gained more than 13% in the past six months, is now trading close to its levels a year ago. In September, the stock suffered a selloff after the company reported weaker-than-expected first-quarter results and lowered its guidance.

Q2 Report Due

When the Memphis-headquartered cargo giant reports second-quarter results on December 19, after the closing bell, the market will be looking for adjusted earnings of $3.95 per share, compared to $3.99 per share in the corresponding quarter last year. Revenues are expected to remain broadly unchanged at $22.12 billion in the November quarter.

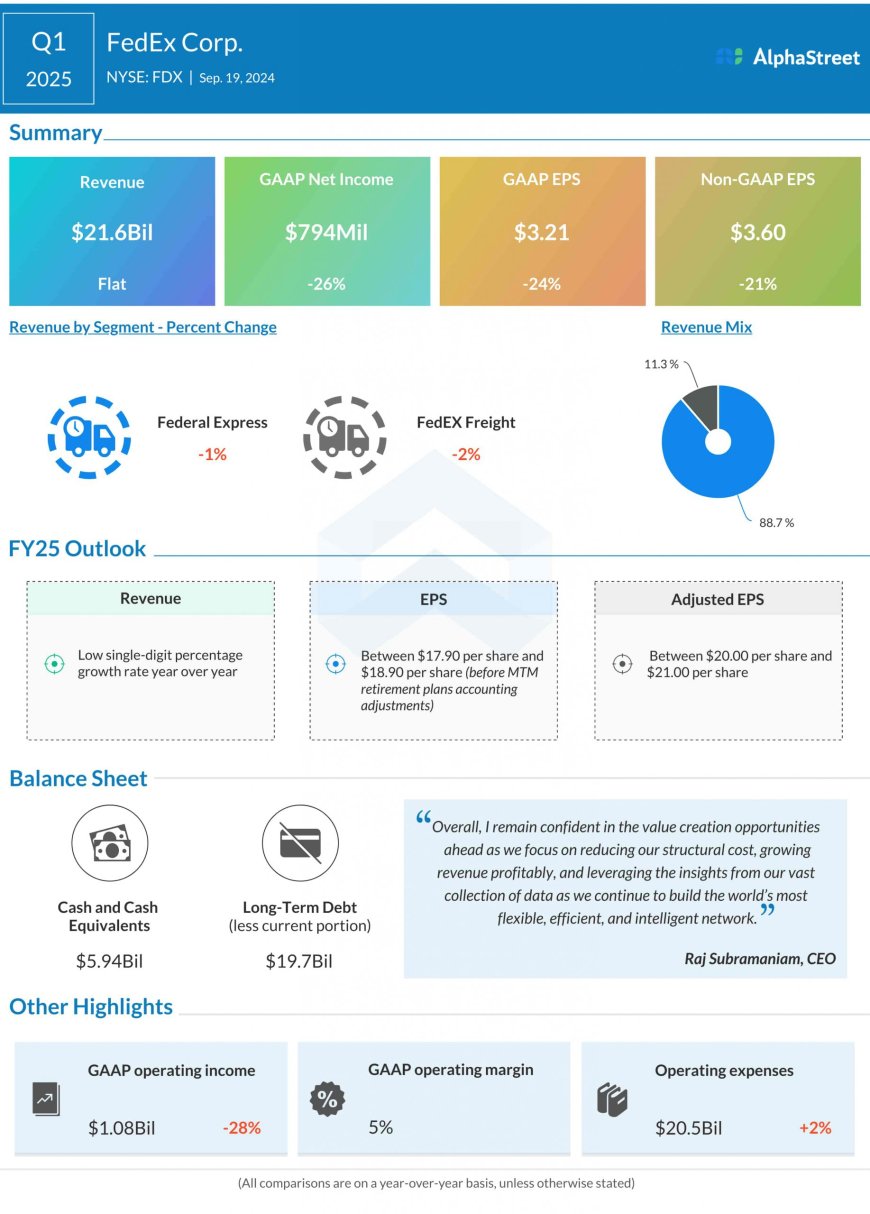

In the first three months of FY25, revenues were $21.60 billion, compared to $21.70 billion in the year-ago quarter. Earnings, excluding one-off items, decreased to $3.60 per share in Q1 from $4.55 per share in the prior year period. Unadjusted profit was $0.79 billion or $3.21 per share in the August quarter, vs. $1.08 billion or $4.23 per share in Q1 2024. Both earnings and revenues fell short of expectations, after beating in the prior quarter.

Road Ahead

It is expected that FedEx would perform better in the back half of the year, as the company further reduces structural costs through its DRIVE initiative. The business will also benefit from improvements in the economy and the Fed’s interest rate cuts. While streamlining the business, the FedEx leadership is also providing value to customers through digital innovation, with a focus on improving the supply chain and ensuring a better logistics experience. The company’s technology push gains significance amid growing competition from e-commerce players like Amazon.

“Within our surface operations, we’ll keep focusing on the end-to-end efficiency initiatives, including optimizing our rental fleet and maximizing rail usage. In the air network and international category, a majority of our savings in the remainder of the year will come from Europe. While we realized some Europe savings in the quarter, most of our Europe-related DRIVE savings was skewed toward the second half of FY ’25 as we achieved efficiency and productivity improvements across the region” FedEx CEO Rajesh Subramaniam said at the Q1 earnings call.

FedEx’s stock, which has stayed above its 52-week average for nearly three months, traded lower throughout Friday’s session.

The post FedEx (FDX) is preparing to report Q2 results. Here’s what to expect first appeared on AlphaStreet.