EV Market Outlook: Top Trends That Will Affect EVs in 2025

Electric vehicles (EVs) are an essential part of the transition to a cleaner, greener economy in the fight against climate change.The technology is also a key driver of demand for battery metals, such as lithium, cobalt, graphite, nickel and copper. Investors interested in these metals are keeping a close eye on the growth outlook for the global EV market.So what are the key EV trends to follow? Here the Investing News Network (INN) takes a look at what moved the market in 2024, as well as what’s on the horizon for the EV sector in 2025.How did the EV market perform in 2024?Global EV sales reached 13.3 million units in the first 10 months of the year, according to EV market research firm Rho Motion, up 24 percent over the same period last year. We’re waiting on the full-year figures as of the date of this publication.However, this growth hasn’t played out equally across the three major regional markets.Once again China is leading the way, amassing nearly two-thirds of total global sales. Purchases of EVs in this region were up 38 percent to 8.4 million units. Compare this to the 9 percent growth in the US and Canada, and the 3 percent decline in Europe.China’s dominance in the global EV market is beginning to bleed into the regional markets. Earlier this year, China’s BYD (OTC Pink:BYDDF,HKEX:1211), the world’s largest EV manufacturer, launched an affordable EV model priced below US$10,000.With the North American and European EV manufacturers already struggling to gain market share in their own domestic spheres, these cheaper Chinese EV models pose a significant problem.In response to the threat, the Biden administration increased tariffs on Chinese EVs to 100 percent, and disqualified imported EVs from the US$7,500 federal tax credit. The European Union (EU) also imposed its own tariffs on Chinese EVs, ranging from 17.4 percent for BYD to 38.1 percent for SAIC Motor Company (SHA:600104).US EV industry facing challengesAs the number one seller of EVs in the US, Tesla’s (NASDAQ:TSLA) performance has an outsized impact on the region’s EV industry. Lagging sales of Tesla models in 2024 have dragged down the overall performance of the North American EV market. According to data released by the Electric Vehicle Council in early December, Tesla’s total sales for 2024 are down by 20.88 percent compared to the previous year.Another red flag for the US EV industry is Ford’s (NYSE:F) decision in June to suspend the release of new battery electric vehicle (BEV) models citing a lack of a strong business case for such an investment. The auto giant was the second best-selling EV brand in the country in the first half of 2024 before it was overtaken by rival General Motors (NYSE:GM). In November, Ford announced it would pause production of its F-150 Lighting truck for the remainder of the year.General Motors has made cuts to its initial planned 2024 EV production range of 50,000 units to a range of 200,000 units to 250,000 units for the year. In addition, the US auto manufacturer is delaying the launch of the first Buick EV model.Despite these challenges, the US EV market landscape has several bright spots. Third quarter EV sales grew by 11 percent year-over-year, according to Cox Automotive. Even Tesla sales returned to growth, up 6.6 percent, and GM sales posted a 60 percent gain for the same period.“The growth is being fueled in part by incentives and discounts; but as more affordable EVs enter the market and infrastructure improves, we can expect even greater adoption in the coming years,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive.European EV market sluggishThe European market has also struggled this year, especially in Germany, the largest producer of EVs in this region. The German government cut subsidies for EVs at the end of 2023, which has led to less incentive for buyers in 2024.The German EV industry is the second largest in the world after China. A significant drop in demand in Germany has understandably had a dramatic impact on European EV production.In October, Volkswagen (OTC Pink:VLKAF,FWB:VOW), the region’s largest automaker, announced its intentions to close three German plants to cut costs as it tries to stave off competition from cheaper Chinese EVs.Europe’s auto makers are facing a growing challenge ahead of the 2035 ban on the production of any new ICE vehicles. New EV registrations have fallen in the second half of the year, including in France and Italy, while the UK has seen some positive gains, reports Bloomberg.What's slowing down EV demand?One of the biggest challenges facing the EV industry is appealing to mainstream consumers, many of which are dealing with high interest rates amidst a cost-of-living crisis.Depending on the geographic location and the vehicle type, BEVs are 10 percent to 75 percent more expensive than conventional internal combustion engines (ICE) vehicles. This is making for a less than appealing pitch on the sales floor. Throw in the h

Electric vehicles (EVs) are an essential part of the transition to a cleaner, greener economy in the fight against climate change.

The technology is also a key driver of demand for battery metals, such as lithium, cobalt, graphite, nickel and copper. Investors interested in these metals are keeping a close eye on the growth outlook for the global EV market.

So what are the key EV trends to follow? Here the Investing News Network (INN) takes a look at what moved the market in 2024, as well as what’s on the horizon for the EV sector in 2025.

How did the EV market perform in 2024?

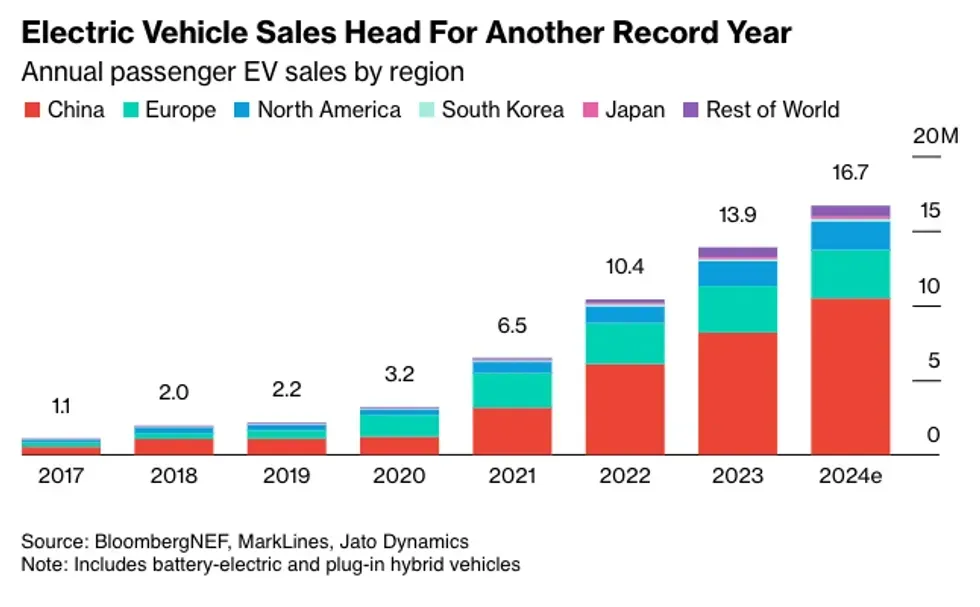

Global EV sales reached 13.3 million units in the first 10 months of the year, according to EV market research firm Rho Motion, up 24 percent over the same period last year. We’re waiting on the full-year figures as of the date of this publication.

However, this growth hasn’t played out equally across the three major regional markets.

Once again China is leading the way, amassing nearly two-thirds of total global sales. Purchases of EVs in this region were up 38 percent to 8.4 million units. Compare this to the 9 percent growth in the US and Canada, and the 3 percent decline in Europe.

China’s dominance in the global EV market is beginning to bleed into the regional markets. Earlier this year, China’s BYD (OTC Pink:BYDDF,HKEX:1211), the world’s largest EV manufacturer, launched an affordable EV model priced below US$10,000.

With the North American and European EV manufacturers already struggling to gain market share in their own domestic spheres, these cheaper Chinese EV models pose a significant problem.

In response to the threat, the Biden administration increased tariffs on Chinese EVs to 100 percent, and disqualified imported EVs from the US$7,500 federal tax credit. The European Union (EU) also imposed its own tariffs on Chinese EVs, ranging from 17.4 percent for BYD to 38.1 percent for SAIC Motor Company (SHA:600104).

US EV industry facing challenges

As the number one seller of EVs in the US, Tesla’s (NASDAQ:TSLA) performance has an outsized impact on the region’s EV industry. Lagging sales of Tesla models in 2024 have dragged down the overall performance of the North American EV market. According to data released by the Electric Vehicle Council in early December, Tesla’s total sales for 2024 are down by 20.88 percent compared to the previous year.

Another red flag for the US EV industry is Ford’s (NYSE:F) decision in June to suspend the release of new battery electric vehicle (BEV) models citing a lack of a strong business case for such an investment. The auto giant was the second best-selling EV brand in the country in the first half of 2024 before it was overtaken by rival General Motors (NYSE:GM). In November, Ford announced it would pause production of its F-150 Lighting truck for the remainder of the year.

General Motors has made cuts to its initial planned 2024 EV production range of 50,000 units to a range of 200,000 units to 250,000 units for the year. In addition, the US auto manufacturer is delaying the launch of the first Buick EV model.

Despite these challenges, the US EV market landscape has several bright spots. Third quarter EV sales grew by 11 percent year-over-year, according to Cox Automotive. Even Tesla sales returned to growth, up 6.6 percent, and GM sales posted a 60 percent gain for the same period.

“The growth is being fueled in part by incentives and discounts; but as more affordable EVs enter the market and infrastructure improves, we can expect even greater adoption in the coming years,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive.

European EV market sluggish

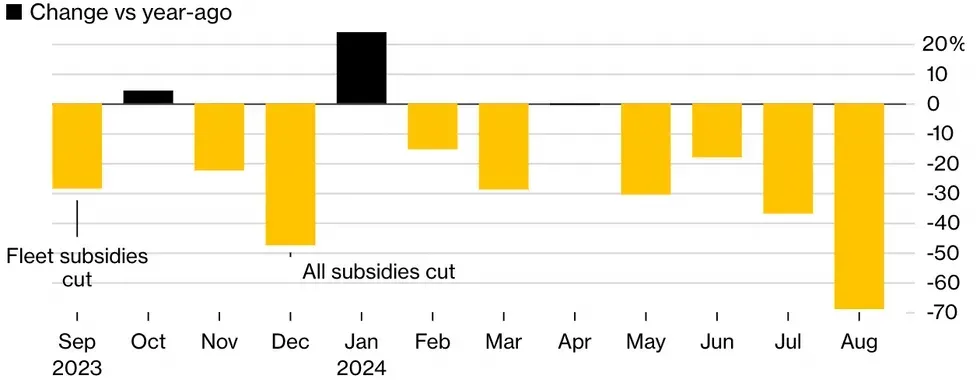

The European market has also struggled this year, especially in Germany, the largest producer of EVs in this region. The German government cut subsidies for EVs at the end of 2023, which has led to less incentive for buyers in 2024.

The German EV industry is the second largest in the world after China. A significant drop in demand in Germany has understandably had a dramatic impact on European EV production.

In October, Volkswagen (OTC Pink:VLKAF,FWB:VOW), the region’s largest automaker, announced its intentions to close three German plants to cut costs as it tries to stave off competition from cheaper Chinese EVs.

Europe’s auto makers are facing a growing challenge ahead of the 2035 ban on the production of any new ICE vehicles. New EV registrations have fallen in the second half of the year, including in France and Italy, while the UK has seen some positive gains, reports Bloomberg.

What's slowing down EV demand?

One of the biggest challenges facing the EV industry is appealing to mainstream consumers, many of which are dealing with high interest rates amidst a cost-of-living crisis.

Depending on the geographic location and the vehicle type, BEVs are 10 percent to 75 percent more expensive than conventional internal combustion engines (ICE) vehicles. This is making for a less than appealing pitch on the sales floor. Throw in the higher cost for tires, one-off repairs and the possibility of having to replace an exorbitantly priced battery, and you can see why the hesitancy is palpable.

Range-anxiety, especially in colder climates, long charging times and a lack of reliable charging infrastructure are also significant barriers to EV adoption. But nothing trumps cost.

A recent PwC survey polled more than 17,000 consumers across 27 countries, and found that even in countries like the Netherlands with advanced charging infrastructure, high costs are still deterring would-be buyers from going electric.

Overall, PwC found that 75 percent of respondents in Europe, the Middle East and Africa cited the cost of EV ownership as the biggest factor swaying their purchasing decision. On top of that, one-third of EV owners surveyed answered they would consider going back to gas-powered vehicles to avoid the high maintenance costs and limited range for long-distance travel.

Subsidies and tax breaks have helped to ease the cost burden, but pullbacks on those government rebates have hit the market hard in some European countries where high interest rates and cost-of-living continue to put an EV purchase out of reach.

Another factor limiting sales in the EU, reported Euronews, has been higher tariffs imposed on low-cost Chinese EVs to limit their ability to displace domestic automakers from the market.

Despite the slowdown in adoption, 2024 is still expected to be another record year for the global EV industry. That was the main takeaway from a presentation at the BloombergNEF Summit in early November given by Aleksandra O’Donovan, the research organization’s head of EVs.

BNEF is forecasting that EV sales worldwide will reach 16.7 million vehicles in 2024, up from 13.9 million the previous year, representing 20 percent of total global vehicle sales this year.

Hybrid EVs gaining market share

One of the important trends in the EV market for 2024 that is likely to carry on into 2025 is the popularity of hybrid models over pure battery electric vehicles (BEVs). This trend is very much in line with the affordability and range anxiety factors influencing sales in today’s EV market.

To meet customers where they are at, auto makers are switching gears to bring more hybrid models to market, including plug-in hybrids (PHEV), rather than BEVs. “Companies are turning to hybrid models to appeal to a more practical and frugal shopper, as wealthy early EV adopters who fueled years of growth have recently fled the market,” reported Business Insider. In this market environment, hybrid-focused auto makers such as Toyota (NYSE:TM,TSE:7203) and Ford are expected to outperform. GM is also planning to launch more hybrid EV models in 2027.

Even in China, the world’s largest EV market, plug-in hybrids are driving much of the growth in overall EV sales. BNEF states that while BEV sales in China were up 18 percent in the first 10 months of the year, total plug-in sales were up 37 percent.

Mexico emerging as an EV production hub

Outside of these three major regions, EV sales are growing in emerging markets. J.D. Power’s Autovista Group reported that in 2024, “Volumes grew by more than 100% in markets including Australia, Thailand, Brazil, Turkey, Malaysia, and Mexico in 2023 and more than 50% in India and Japan”.

Mexico, for example, is on its way to becoming a major EV production hub. “We're already seeing EV production take off in Mexico over the past 12 to 18 months,” said Rho Motion research analyst George Whitcomb during a Benchmark-hosted webinar INN attended in late November.

The growth in Mexico’s EV industry can be attributed to a number of factors, explained Whitcomb. Namely, its established transport production chains, geographic location, strong position in the traditional global auto industry and trade agreements. “But from an EV standpoint, in particular, the US IRA has been central to stimulating EV production in Mexico,” he added.

What’s the EV market outlook for 2025?

EV Volumes, a part of the JD Power Group, is forecasting that the total EV share of light-vehicle sales worldwide will reach 22.6 percent in 2025. Further out, the firm sees EVs market share surging to 44.6 percent in 2030, and 69.5 percent in 2035.

Looking at the broader market (which includes buses, vans and heavy trucks), tech research firm Gartner predicts by the end of 2025, 85 million EVs will be on the road, a year-over-year increase of 33 percent.

China continues to dominate EV market

“The growth in 2025 will be driven primarily by higher EV sales in China (58%) and Europe (24%), which together are projected to represent 82% of total EVs in use worldwide,” states Jonathan Davenport, Senior Director Analyst at Gartner. In 2025, the firm estimates 49 million EVs will be on Chinese roadways, compared to 20.6 million in Europe and 10.4 million in North America.

Gartner sees China continuing its domination of the global EV landscape for at least another decade. EV Volumes expects BEVs to “gain ground in the BEV-PHEV mix from 2025 onwards” in China as the government offers further financial supports to motivate consumers.

Europe’s EV market will cool before heating back up

Europe’s light-vehicle EV market will see a growth rate of 22.8 percent in 2025, according to EV Volumes, followed by a further 20.1 percent increase in 2026 and 21.1 percent in 2027. By 2030, the firm sees EVs accounting for 61 percent of the overall light-vehicle market in the region.

Government subsidies will continue to be a key factor shaping Europe’s EV industry for 2025, says Rho Motion. For example, the agency notes that France is set to follow Germany’s lead and make a 50 percent cut to its EV subsidies for 2025 as the government works to address fiscal challenges. Spain is also considering reducing subsidies.

However, Forbes reported that professional services firm Accenture has called the slower growth in Europe’s EV market “a temporary blip” as a recent consumer survey showed that “every other consumer in Europe plans to buy an EV in the next 10 years and every fifth consumer in the next 5 years.”

US EV market in the Trump era

EVs are projected to reach 13.5 percent market share for overall US light-vehicle sales in 2025, as per EV Volumes, up from an estimated 10.3 percent in 2024. That figure is expected to increase to 39.7 percent by 2030 and 71.8 percent in 2035. Within the EV market itself, BEVs are still dominating over hybrid models and are expected to account for 82.4 percent of total US EV sales for 2025, up from 78.6 percent in 2024.

The Inflation Reduction Act (IRA) brought forward by the Biden Administration in mid-2022 introduced significant tax credits for EV buyers, helping to take the edge off the cost burden of buying into the clean technology. While the IRA is slated to be in effect through 2032, there are concerns that President Donald Trump may reverse those benefits once he takes office in 2025.

“The US market remains buoyant in part thanks to IRA funding for consumers switching to electric which may be at risk with the start of the Trump presidency,” said Rho Motion Data Manager Charles Lester.

As with his first term, Trump’s return to office has thrown many markets for a loop. Will the US EV market survive the Trump factor? Check out INN’s article on Is Trump a Threat to US EV and Battery Supply Chain Growth?

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.