Earnings Preview: Micron (MU) expected to begin FY25 on a high note

For Micron Technology Inc. (NASDAQ: MU), fiscal 2024 marked a turnaround year as the business emerged from a challenging phase and regained its strength. As it prepares to report first-quarter […] The post Earnings Preview: Micron (MU) expected to begin FY25 on a high note first appeared on AlphaStreet.

For Micron Technology Inc. (NASDAQ: MU), fiscal 2024 marked a turnaround year as the business emerged from a challenging phase and regained its strength. As it prepares to report first-quarter results, the market remains optimistic about the chipmaker maintaining the recovery momentum.

On Tuesday, the stock gained in the premarket session after the US Department of Commerce finalized a subsidy of more than $1.6 billion for the company. However, the stock changed course in the early hours of the regular session and traded lower. It has lost around 35% since climbing to a record high mid-year.

Q1 Report Due

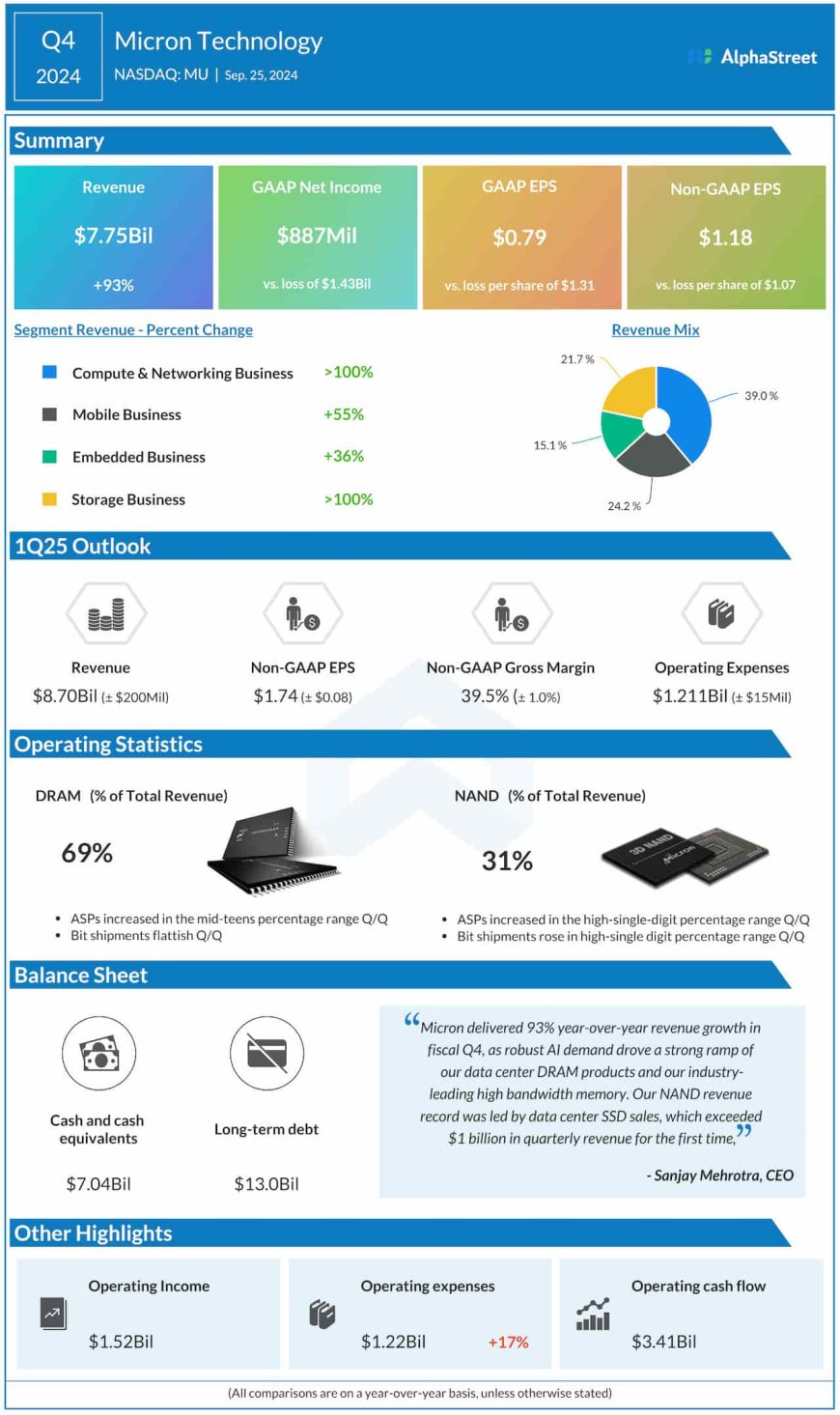

The company has delivered better-than-expected quarterly numbers regularly over the past one-and-half years, and the trend is expected to continue in the first quarter. Market watchers forecast adjusted profit of $1.77 for Q1, on a per-share basis, which represents a significant improvement from the prior-year period when it incurred a loss of $0.95 per share. Revenue is expected to surge 84% year-over-year to $8.71 billion in the November quarter.

The results will be out on Wednesday, December 18, at 2:35 pm ET. The Micron leadership forecasts adjusted net income of around $1.74 per share for the first quarter, on revenues of approximately $8.70 billion. It sees Q1 gross margin rising to around 39.5%, on an adjusted basis.

Also Read: Micron (MU) Q4 earnings beat Street view

From Micron’s Q4 2024 earnings call:

“We look forward to delivering a substantial revenue record with significantly improved profitability in fiscal 2025, beginning with our guidance for record quarterly revenue in fiscal Q1. Micron is ramping production of the industry’s most advanced technology nodes in both DRAM and NAND. Our one-beta DRAM and G8 and G9 NAND nodes are ramping in high volume and will become an increasing portion of our mix through fiscal 2025. As a reminder, our G8 NAND node refers to our 232-layer NAND technology node.”

$1.6-Bln Grant

Under the CHIPS act, the government this week finalized a subsidiary of $1.6 billion for Micron to support the construction of three advanced chip fabrication facilities in the US. Currently, the construction of a new fab is progressing in Idaho, and the management is working to secure permission from the state and federal agencies for the New York facility.

The company’s high-bandwidth memory chips have elicited a lot of interest lately as they are expected to play a crucial role in the development of generative AI applications. With an innovative product lineup, Micron looks on track to leverage the ongoing AI revolution.

Strong Results

The tech firm reported adjusted earnings of $1.18 per share for the final three months of fiscal 2024, compared to a loss of $1.07 per share in the year-ago period. Earnings topped expectations. On an unadjusted basis, net income was $887 million or $0.79 per share in Q4, compared to a loss of $1.43 billion or $1.31 per share in the corresponding period of 2023. Fourth-quarter revenues increased sharply to $7.75 billion from $4.01 billion in the prior year quarter and came in above analysts’ consensus estimates.

Micron’s stock was trading down 3% on Tuesday afternoon, reversing its early gains. It has grown about 15% this year.

The post Earnings Preview: Micron (MU) expected to begin FY25 on a high note first appeared on AlphaStreet.