After a mixed start to FY25, what is in store for Procter & Gamble?

Consumer goods behemoth Procter & Gamble Company (NYSE: PG) has maintained stable revenue performance and profitability, despite geopolitical uncertainties and cautious consumer spending. The company’s organic sales increased in the […] The post After a mixed start to FY25, what is in store for Procter & Gamble? first appeared on AlphaStreet.

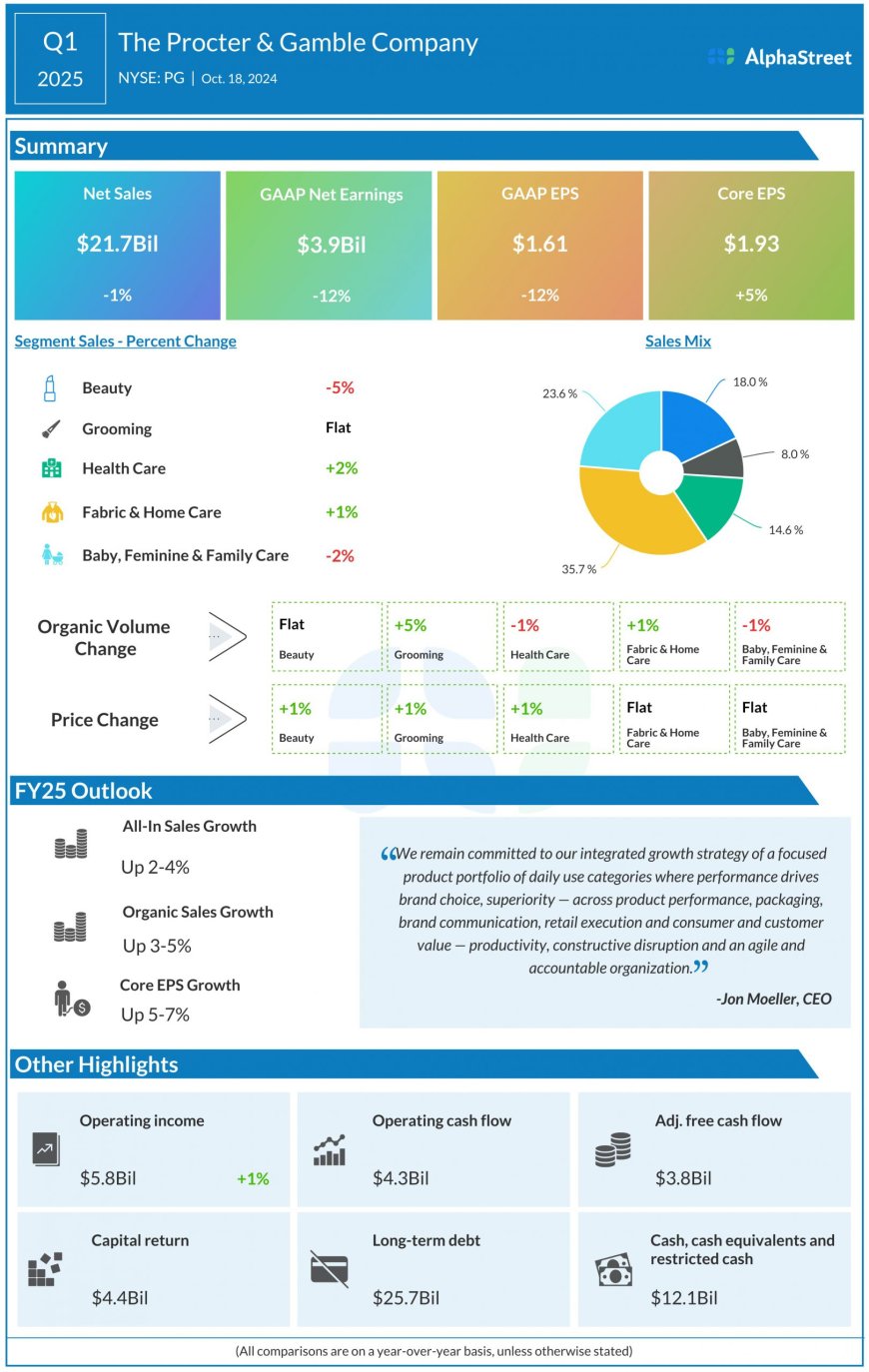

Consumer goods behemoth Procter & Gamble Company (NYSE: PG) has maintained stable revenue performance and profitability, despite geopolitical uncertainties and cautious consumer spending. The company’s organic sales increased in the last fiscal year, aided by higher prices and a favorable product mix.

P&G’s stock has lost 7% in the past 30 days as it entered a downward spiral after hitting an all-time high in early December. It suffered a fresh fall last week, reflecting the mixed investor sentiment ahead of next week’s earnings. However, PG remains a favorite among income investors, thanks to regular dividend hikes and the above-average yield.

Estimates

Market watchers remain cautious in their projections on the company’s second-quarter performance. The results are expected to be out on Wednesday, January 22, at 6:55 am ET. The consensus forecast is for a modest increase in core earnings to $1.87 per share in Q2 from $1.84 per share a year earlier. The consensus sales forecast is $21.66 billion, representing a 1% year-over-year increase.

While the company’s profit has been healthy despite inflation, margins are often hit by higher input costs and pricing pressure amid stiff competition in the consumer goods market. The trend will likely continue in the near term, aggravated by the slowdown in spending due to the absence of the government’s stimulus program that lifted consumer confidence post-pandemic.

Road Ahead

For the whole of fiscal 2025, the P&G leadership forecasts a 2-4% year-over-year increase in net sales, with an estimated organic sales growth of 3-5%. Core profit is expected to increase between 5% and 7% in FY25, and unadjusted earnings in the range of 10% to 12%.

From Procter & Gamble’s Q1 2025 earnings call:

“We are driving constructive disruption of ourselves and our industry, a willingness to change, adapt, and create new trends, technologies, and capabilities that will shape the future of our industry and extend our competitive advantage. We are benefiting from an organization that is empowered, agile, and accountable. Our strategic choices on portfolio, superiority, productivity, constructive disruption, and organization reinforce and build on each other and we remain confident in our strategy and in our ability to drive market growth and deliver balanced growth and value-creation.“

In the first three months of fiscal 2025, P&G’s net sales edged down to $21.7 billion from $21.9 billion in the prior-year quarter. Organic sales, which excludes the impacts of foreign exchange and acquisitions and divestitures, increased 2% year-over-year. The top-line fell short of analysts’ expectations, marking the fourth straight miss.

Earnings Grow

Core earnings, adjusted for special items, rose 5% annually to $1.93 per share in the first quarter. Over the past two years, the company consistently outperformed Wall Street’s quarterly profit estimates, including in Q1. On a reported basis, net income attributable to shareholders was $3.95 billion or $1.61 per share in the September quarter, compared to $4.52 billion or $1.83 per share in the first quarter of 2024.

The recent downturn has dragged the stock below its 52-week average price. The stock traded flat on Tuesday afternoon, after opening the session below $160.

The post After a mixed start to FY25, what is in store for Procter & Gamble? first appeared on AlphaStreet.